GDAX Review – Coinbase’s Advanced Exchange, How Good is It?

Global Digital Asset Exchange, neatly abbreviated to GDAX,

is one of the most famous Bitcoin and cryptocurrency trading exchanges

in the world. The platform is aimed at more advanced users and

professional traders, but what advantages or disadvantages does it have

compared its competitors such as Kraken or Gemini?

In this review, you’ll find out about the features the

company offers, how it performs, and whether it suits your

cryptocurrency needs.

GDAX Company Overview

GDAX is building a stellar reputation as we watch the growth

of cryptocurrencies accelerate into the public consciousness. More and

more investors are coming to the market, and it’s important to

understand the differences in the platforms available.

If you’re considering GDAX, you likely already own some

Bitcoin and perhaps other digital assets. It’s an advanced trading

platform that’s aimed at serious traders.

If you are already a user at Coinbase and want to expand your trading capabilities, then working on the platform will be a simple treat for you.

GDAX is owned by the same company as Coinbase and operates

as a sister trading platform. The company is based in San Francisco and

has been in operation since 2012, so it knows its way around the crypto

markets.

Coinbase account owners can use the same account to log into

GDAX and start trading almost immediately. You’ll need to move funds

from one wallet to another, but the beauty of cryptocurrency makes that a

cinch.

Of course, you don’t need to be a Coinbase customer to work on the

exchange. If you’re looking to move trading platforms, then you will be

pretty pleased with GDAX’s slick design and major currency support.

GDAX Currency Support

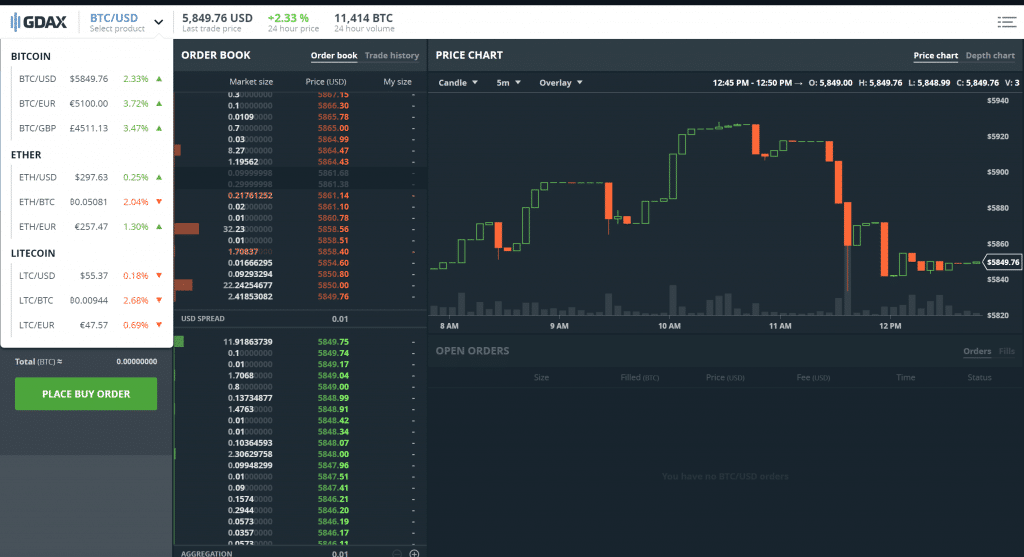

GDAX provides decent coverage of major cryptocurrencies and fiat currencies. Bitcoin, Ethereum, and Litecoin

are all available for market trading. You can deposit and work in any

of these cryptos, along with US dollars, euros, and British pounds.

You can trade Bitcoin with all three fiat options, while Ethereum and

Litecoin trades can be made with dollars, euros, and Bitcoin. This

might be a little frustrating for British users—although most European

exchanges will work in euros rather than pounds.

It’s appealing that Ethereum and Litecoin can be traded with fiat

currencies. I often find that acquiring these cryptos requires you to

spend Bitcoin, and you may not want to start carving up Bitcoin

investments with prices moving upward.

GDAX Country Support

The platform is a worldwide trading exchange, so naturally

it has pretty decent functionality around the globe. The selection of

currency support makes it particularly appealing to users the United

States, Europe, and the United Kingdom. Australia and Singapore are

supported for trading but not in their fiat currencies; users from these

areas may have to use different currency pairs. The full list is

available here.

GDAX Fees

GDAX’s trading fees are dramatically lower than those you’ll find on

Coinbase. The fact that Coinbase accounts work on GDAX is super handy

for any user who wants to cut costs.

As with most exchanges, a bank transfer is necessary, or you can

deposit crypto funds directly into a GDAX hot wallet. Once funds are

accessible, trading rates vary from 0.1% to 0.25%. That’s a huge savings

compared to an option like Coinbase, where you could be paying upwards

of 4% for buys with credit cards.

The full information on fees is available here.

GDAX Customer Support

Customer support is variable across the cryptocurrency industry, with

many reporting bad experiences and others sounding the success siren.

GDAX does a decent job in this area; although as with most sites, you

are encouraged to contact the team via email. You’ll generally get a

reply in 24–72 hours depending on your inquiry.

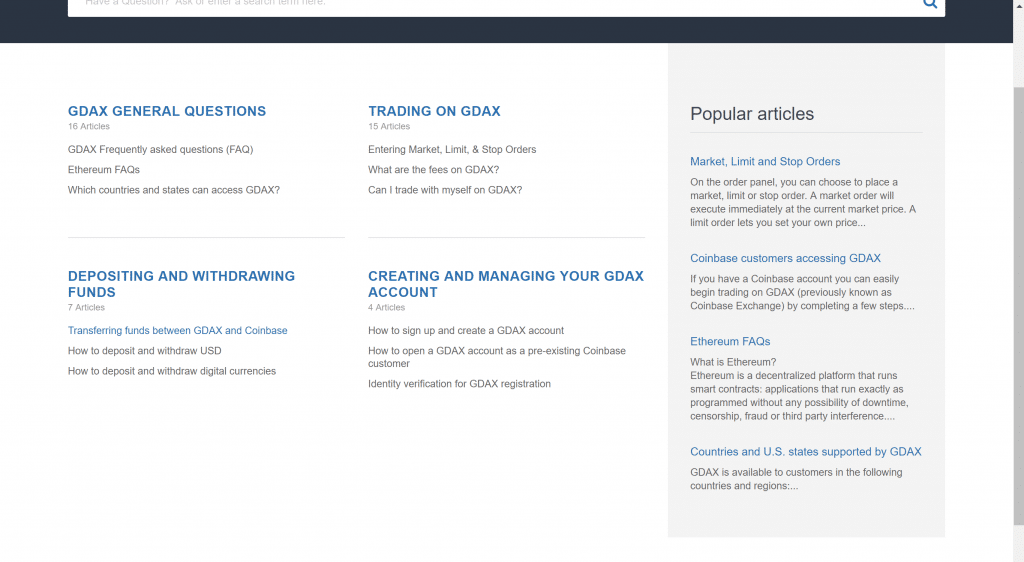

GDAX’s Help section is nicely laid out and has an adequate amount of

information. It can walk you through the steps to moving to GDAX from

Coinbase, and it also includes how-to guides and answers.

Overall, GDAX meets expectations in this area without being a shining light in the industry. However, since this is the same company that is responsible for Coinbase’s support, there might be some hiccups here and there (read more here).

GDAX Public Opinion

The ability to ride along with the uber-success of Coinbase is pretty handy for the advanced trading exchange. Coinbase is known to be the industry leader when it comes to Bitcoin buy options, which should make you feel pretty confident about using the GDAX platform.

The site has had problems in the past, most notably a flash crash on its Ethereum exchange.

Traders saw their Ethereum funds temporarily reduced from $300 to as

low as $0.10 after a multimillion-dollar sell-off. The company handled

the situation pretty well, with prices recovering quickly and those who

lost money being refunded. It has since been confirmed that there was no

bug in the system—still, lessons were learned about the pitfalls of the

exchange.

I always like to have a quick Google to see what comes up under a

company’s name. Most of the reviews and ratings for GDAX around the web

are very positive. Questions like “Is GDAX a scam?” are not prominent

and are dismissed, which can only be a bonus for the platform and the

industry as a whole.

Conclusion

GDAX provides a nice option for advanced and professional

traders, particularly in the United States and Europe. It’s an

all-around package that’s ideal for anyone who already owns major

cryptocurrencies and wants to trade with low fees. The platform’s

incorporation of GBP as a currency is a handy addition to the UK market

in addition to the USD and EUR trading we’ve come to expect.

I like the pathway GDAX creates for users to move from

making their first investments to getting a bit more hands-on with

trading. You can start to understand the basics of cryptocurrencies and

transactions through Coinbase

before seamlessly moving to GDAX. It’s a development that makes the

process straightforward, especially as so many people hold Coinbase

accounts.

0 Response to "GDAX Review – Coinbase’s Advanced Exchange, How Good is It?"